aluxum

This article was coproduced with Mark Roussin.

Not long ago, the housing market was once the darling of the U.S. economy. It was an unstoppable force, with sellers making money hand-over-fist in ever-rising amounts.

Now things are beginning to soften – though notice I didn’t say “decline” or “weaken.” Only “soften.”

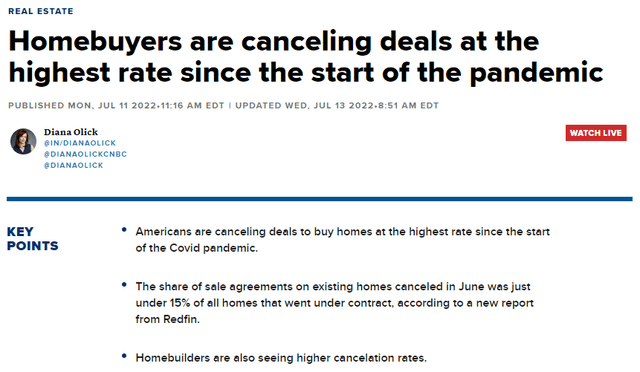

That might sound surprising considering our current situation, with red-hot inflation, weakening job stats, and what looks like an oncoming recession. And indeed, buyers are becoming more hesitant to sign on the dotted line.

Those who do have been canceling them at the highest rate since early 2020. In the month of June alone, 15{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} of all homes that went under contract were apparently canceled.

CNBC

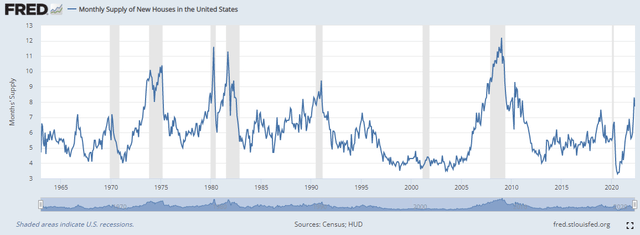

As for supply, it’s been historically low – part of the reason prices have been so high. And while we were seeing a consistent uptick in supply for a bit there…

The latest supply levels have us back to what we were experiencing in early 2011.

FRED

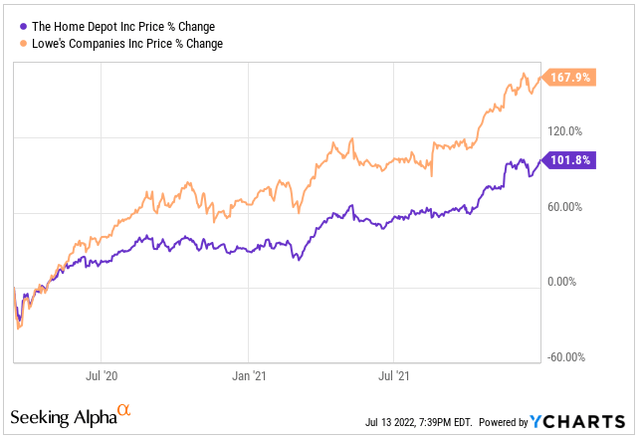

Because of the housing market being what it’s been – for the reasons it’s been – many Americans turned to improving their current homes instead. Which brings us to The Home Depot, Inc. (HD) and Lowe’s Companies, Inc. (LOW).

From the pandemic lows seen in March 2020 to their highs in late 2021… HD and LOW saw their stocks appreciate 102{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} and 168{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}, respectively.

Seeking Alpha / YCharts

This year, of course, they’ve fallen with the larger market. They’re both down 30{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} on the year.

Does that make them bargains? Let’s look at the details to find out!

Home Depot: The Gold Standard

Home Depot is the largest home-improvement retailer and the industry’s gold standard for years. It’s backed by strong fundamentals, and investors have benefited greatly as a result.

Of course, past performance doesn’t necessarily equate to future performance. So let’s begin our research by looking at HD’s most recent results.

Home Depot reported its Q1 earnings back in May. Sales came in at $38.9 billion, which was a 3.8{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} increase over the prior year. And comparable sales – which only considers stores that have been open for more than 12 months – were up 2.2{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} globally and 1.7{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} in the U.S.

Obviously, that’s very low growth. But we do need to put that in context.

To understand how much the stimulus checks boosted home improvement, just look at Home Depot’s Q1-21 U.S. same-store sales. Those increased 30{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} year over year.

That there should tell you all you need to know about a home improvement boom. And maybe – just maybe – those same-store sales upticks this time around weren’t that bad after all.

Moving right along, the company saw operating margin of 15.2{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} in Q1-22. That was down from 15.4{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} the previous year.

Some key performance indicators (KPIs) we like to follow when it comes to HD are:

- Customer transactions

- Average tickets

- Sales per retail square foot.

Now, during Q1, customer transactions fell 8.2{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} to 410.7 million. This is cause for concern that the slowdown has begun. But again, we must remember the quarter we’re comparing it to.

Average ticket increased 11.4{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} in Q1, which was expected given where inflation has gone. And sales per retail square foot increased 2.7{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}.

The reason Home Depot has been the sector’s gold standard is how efficient it’s made its business. As a result, it’s maintained a strong balance sheet.

And that then further strengthens its value proposition.

Home Depot Continued

As of Q1-22, HD had debt totaling $41.6 billion with $2.8 billion of cash on hand. That’s not a problem for us though.

Not when the home improvement giant has been a cash-flow-generating machine. During the first quarter alone, HD generated $3.1 billion in free cash flow – which was down from the insane $5.8 billion it generated in Q1-21.

Plus, Home Depot has a pristine A credit rating, which helps it out as well.

And it goes on from there, including the value behind all the real estate it owns. That’s an area that isn’t often discussed enough.

As of the end of its most recent fiscal period, HD had 2,135 store locations – not including warehouses and distribution centers. It owns 89{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} of them, with 11{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} being leased generally from real estate investment trusts (“REITs”) such as Realty Income Corporation (O).

You may have noticed how Kohl’s (KSS) has been in the news a lot lately with different bidders lining up. It’s not so much that those outsiders want department stores…

They want to get their hands on all that real estate. This is similar to Sears back in the day.

(Note: I just wrote a deep dive on KSS real estate HERE)

Of course, there’s a far cry between Kohl’s and Home Depot. Over the years, the latter has been a very shareholder friendly company:

- Returning money to shareholders by way of share buybacks

- Increasing its dividend for nine years now

- Overseeing a five-year dividend growth rate of 17.6{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}.

Currently, the company pays an annual dividend of $7.60. That equates to a dividend yield of 2.67{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}, slightly above its five-year average of 2.15{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}.

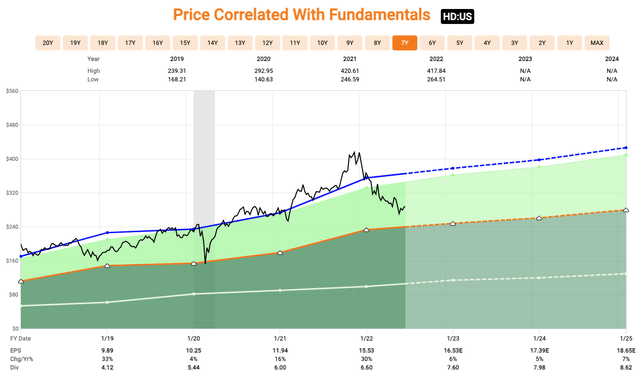

Shares of HD currently trade hands at a 17.4x forward earnings multiple compared to its 22.8x five-year average. This suggests shares are trading at a very reasonable discount right now.

FAST Graphs

Lowe’s: Closing The Gap

Next we’ll discuss Lowe’s, which is often considered second fiddle to Home Depot, and rightfully so. For years, it’s had plenty of missteps, from poor acquisitions to lack of leadership.

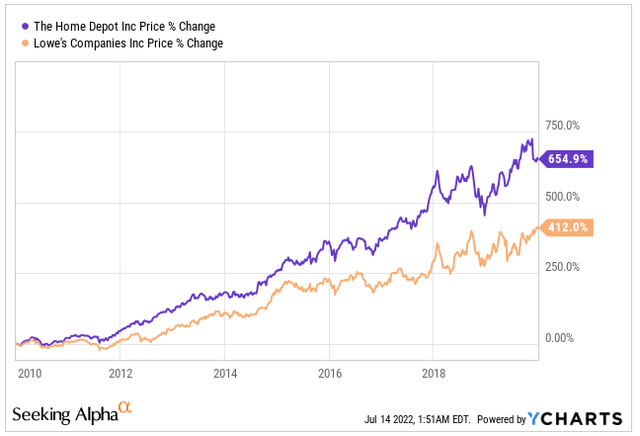

From the start of 2010 through 2019, HD dominated Lowe’s in almost every aspect – which showed in their stock price performances.

Seeking Alpha / YCharts

As shown, HD outperformed LOW by over 240{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}!

Lowe’s knows this, which is why the board hired industry veteran Marvin Ellison as CEO in July 2018. Before that, Ellison served a stint as CEO at JCPenney. And before that…

He worked for over a decade at Home Depot. So he knew exactly what made that company tick.

Mr. Ellison hit the ground running and has since put his fingerprints all over Lowe’s. He’s:

- Made improvements to store layouts

- Improved supply chain issues

- Lowered the number of SKUs to cut out low-performing products

- Focused more on digitization

- Turned significant attention to gaining professional customers’ trust.

The last two items in that list are probably the most important.

For one thing, companies that fail to build out an online presence are getting left behind. So we’re happy to see Lowe’s investing in technology, both online and in-stores.

Online sales and buy-online-pickup-in-store options have become very popular at both HD and Lowe’s alike.

Secondly, pro customers – who have overwhelmingly favored HD over the years – have taken obvious notice of the changes over at Lowe’s.

During Q1-22, Lowe’s saw revenue fall 3.1{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} to $23.7 billion, and U.S. comp sales fell by 3.8{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}. Again, the quarter was a very tough comparable to make.

But the company did expand gross margins by 74 basis points to 34.03{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}. And operating margin climbed 67 bps to 13.96{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}.

Don’t ger us wrong. We still recognize that Home Depot reigns here. But the last two figures above still provide reason to be positive about LOW.

The sales are there, and if it can continue finding ways to become more efficient? That will make direct impacts to the bottom line.

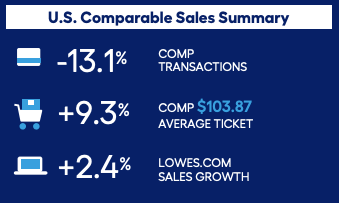

Next, let’s take a look at some of those KPIs we looked at with HD.

(LOW Investor Relations)

The number of comparable transactions were down 13.1{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} during the quarter. Yet the average ticket climbed 9.3{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}, largely due to inflation.

Meanwhile, online sales grew 2.4{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}, which is lower than what Lowe’s had been growing. But this is largely due to the fact Q1-21 was such a big quarter.

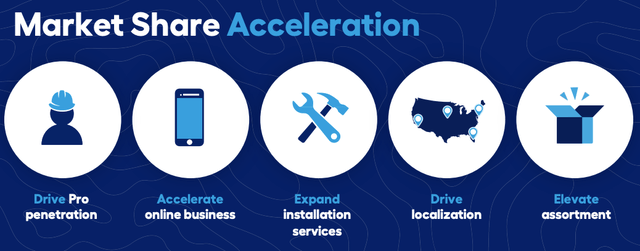

Here’s a look at some of the company’s focus moving forward:

(LOW Investor Relations)

The first thing you see is a focus on “pro penetration,” or professional customer engagement – which essentially means pulling them from HD. LOW reported 20{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} growth in that area for Q1-22 after rising 36{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} in 2021.

So you can definitely see the headway the company is making. Though there’s still plenty of room to improve, including when it comes to Lowe’s balance sheet, where it has $28.9 billion of debt outstanding and $3.8 billion of cash on hand.

The company operates 1,971 stores in the U.S. and Canada, of which it owns 84{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}.

Lowe’s has a tremendous dividend track record, having increased its dividend for 58 consecutive years now. Its five-year dividend growth rate is 18{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}.

That long of a history with that high of a growth rate isn’t something you see all that often. Yet I’m sure it still managed to surprise its shareholders in May when the board raised the dividend by an astounding 31{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}!

That had to put a smile on every LOW shareholder’s face.

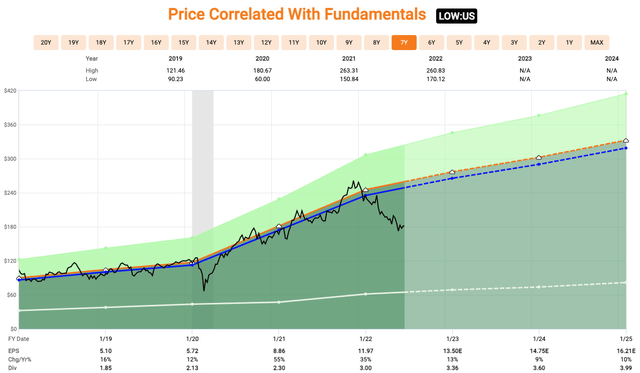

The current annual dividend is $4.20, which equates to a 2.3{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d} yield – far above its five-year average of 1.75{f32667846e1257729eaaee80e922ba34a93c6414e9ad6261aff566c043b9e75d}. And shares currently trade at a forward earnings multiple of 13.5x compared to a five-year average of 19.7x.

FAST Graphs

In Conclusion…

Both Home Depot and Lowe’s are coming off two strong years but have since suffered along with the greater market.

Regardless, both companies are trading at a sizable discount, and both are worthy of consideration for your portfolio. Both companies are reputable dividend-payers too with great potential for strong growth in the long-term.

But, of course, we have to pick a winner here. In which case, Lowe’s continuing improvements can’t go unnoticed.

CEO Marvin Ellison has done a very fine job at closing the gap between it and HD, with more work to do. This provides plenty of upside potential moving forward.

Up next: The Battle of the Auto Parts Chains